Ask the Experts: What Can I Do if My Insurance Won’t Cover Obesity Treatments?

by Paul Davidson, PhD; Sunil Daniel, MD, FTOS, FOMA; and Sarah Bramblette, MSHL

Spring 2024

This section of Weight Matters Magazine is dedicated to bringing you insightful discussions with knowledgeable professionals who can provide valuable advice on various health-related topics. In this issue, we asked a panel of experts to share their thoughts on options and actions people can take when they don’t have insurance coverage for obesity treatments. Here’s how a psychologist, a medical doctor, and someone with lived personal experience with obesity answered the question.

Answer provided by Paul Davidson, PhD

Life can seem unfair, especially for people dealing with obesity. Insurance companies have to balance paying for medical care with making money, which can lead to decisions that feel unfair. If you’re denied obesity treatment, it can be disappointing, frustrating, or even infuriating. But it’s not the end of the world. Obesity being seen as a disease needing medical treatment is relatively new, so it might take time for more treatments to be accepted and offered to more people. Remember, we’ve lived without these treatments for a long time, and while they offer hope, they don’t replace the ability to change behavior.

Even if you’re denied treatment now, there’s hope for approval in the future. In the meantime, you can do things to help yourself, like staying hydrated, eating healthier foods, being more active, and eating smaller, more frequent meals. Don’t let the denial of care become an excuse to eat mindlessly and self-sabotage. There are also medications that insurance might cover, even if they’re not the newest treatments. You can find qualified providers who can help you on your weight management journey, including behavioral health specialists, through resources like the OAC. Visit the OAC’s provider locator at ObesityCareProviders.com to get started.

You can also advocate for yourself. Talk to your doctor about getting approval for treatment. Sometimes exceptions are made if there are strong reasons for you to get specific obesity treatment. Pharmaceutical companies might have programs to help you afford treatment based on your income. Additionally, you can do an online search for prescription discount programs such as GoodRx. During open enrollment periods, you can look into other insurance plans that might cover the treatment you need. Participating in a clinical trial could give you access to new treatments and possibly some money, too. Some states offer help with medication costs to people who meet income requirements. On a bigger scale, supporting bills like the Treat and Reduce Obesity Act (TROA) can help improve insurance coverage for obesity treatment.

Answer provided by Sunil Daniel, MD, FTOS

To identify if someone has obesity or excess weight, healthcare providers often measure body mass index (BMI). Here’s what the different classifications mean:

- Overweight: BMI between 25.0 and 29.9

- Obesity: BMI of 30 or more

There are various ways to treat obesity, such as changing your lifestyle, taking anti-obesity medications, or having bariatric surgery. Healthcare providers decide if treatment is needed based on certain criteria. These criteria include other health problems such as diabetes, heart disease, sleep apnea, and others. If insurance doesn’t cover obesity treatment, there are still options for patients and their healthcare providers to consider.

For support with changing lifestyle habits, there are programs like the Diabetes Prevention Program (DPP) at many YMCAs, as well as many commercial programs such as Weight Watchers, Noom, TOPS, etc.

Anti-obesity medications (AOMs) can be a bit complicated to understand. They are generally grouped into the following categories:

- Orlistat, phentermine, phentermine and topiramate extended-release, bupropion and naltrexone extended-release, and liraglutide. On average, these medications lead to weight-loss of 5-10%. Some of these medications might be more affordable than some of the newer AOMs. Some medications are available in generic forms, which might be cheaper if you’re paying out of pocket.

- Semaglutide and tirzepatide, which typically result in weight-loss between 15-22%.

Finally, bariatric surgery is a highly effective option for long-term weight-loss if someone meets the criteria (as mentioned before). As we see fewer medications covered by insurance, bariatric surgery remains a strong choice, often resulting in a weight-loss of 25-35% or more, especially when medications aren’t an option.

Answer provided by Sarah Bramblette, MSHL

If you find that your insurance doesn’t cover treatments for obesity, the first step is to get it confirmed in writing. Different employers and government insurance offer various plans, so it’s crucial to know what your plan specifically covers. You can call the Customer Service number to ask for your Plan Document, which may be available online and should contain all your coverage details. Depending on the treatment you’re seeking, check under general physician services, surgical benefits, and prescription benefits. You might have a separate plan for prescription coverage.

It’s important to not only see what’s covered but also to read the exclusion section to understand exactly what’s not covered. For instance, I once had insurance that excluded obesity treatment, but it made an exception for surgical treatment of severe obesity.

If, after carefully reading your coverage details, you discover there’s no coverage for obesity treatments or the specific treatment you need, consider talking to your benefits administrator, usually the Human Resources (HR) department. Sometimes, self-funded insurance plans offer more coverage options. If coverage isn’t available this year, ask what can be done to add it for the next year.

The OAC has information you can share with your benefits administrator, explaining why coverage is essential. Adding your personal story can be persuasive. You can also check the OAC Action Center to contact your members of Congress and urge them to improve coverage for obesity treatments. There might be specific actions for your state.

Other options for paying for treatments include borrowing from your 401(k) and using flexible spending accounts (FSA) or healthcare savings account (HSA) funds. Additionally, considering the availability of many medications that are in the pipeline, see if there are any research studies in your area that you could participate in.

About the Authors:

Paul Davidson, PhD, is an independent behavioral consultant specializing in bariatrics with over 30 years of clinical experience. He is deeply dedicated to his family and to counseling, teaching, research, and advocacy in obesity treatment. For the past decade, he has been a prominent figure in the American Society for Metabolic and Bariatric Surgery (ASMBS), served as Director of Behavioral Services for the Center for Weight and Wellness at Brigham and Women’s Hospital, and instructed at Harvard Medical School. He is also a proud member and contributor to the Obesity Action Coalition (OAC).

Sunil Daniel, MD, is a board-certified obesity medicine physician with fellowship training in clinical nutrition and obesity management. He is a fellow of The Obesity Society and has authored several scientific papers on obesity and its medical management. Dr. Daniel is a Duke University-trained Integrative Health Coach and an innovator who is passionate about developing mobile technology-enabled weight management solutions that are both evidence-based and meaningful to the user. He takes pride in sharing his own successes and challenges with weight loss and maintenance.

Sarah Bramblette, MSHL, is a patient living with lipedema, lymphedema, and obesity. She founded Higher Standard of Care LLC to offer consulting services focusing on access to care for patients with higher weights and larger bodies. She utilizes her decades of lived experience to spread awareness about her conditions while advocating for improved diagnosis, treatment, and insurance coverage. Recently, she became a Standardized Patient to aid in the development of future doctors’ skills in treating patients of all sizes. Sarah currently serves as Board Chair of the Lymphedema Advocacy Group (LAG) and played a pivotal role in the passage and implementation of the Lymphedema Treatment Act. Additionally, she serves on the National Board of Directors for the Obesity Action Coalition (OAC) and advocates for the passage of the Treat and Reduce Obesity Act (TROA). Her blend of personal experience, education, and policy knowledge makes her an impactful advocate whose efforts have benefited millions.

by Joseph Nadglowski, OAC President and CEO; Chris Gallagher, OAC Policy Consultant; and Christine Gallagher, MPAff Winter…

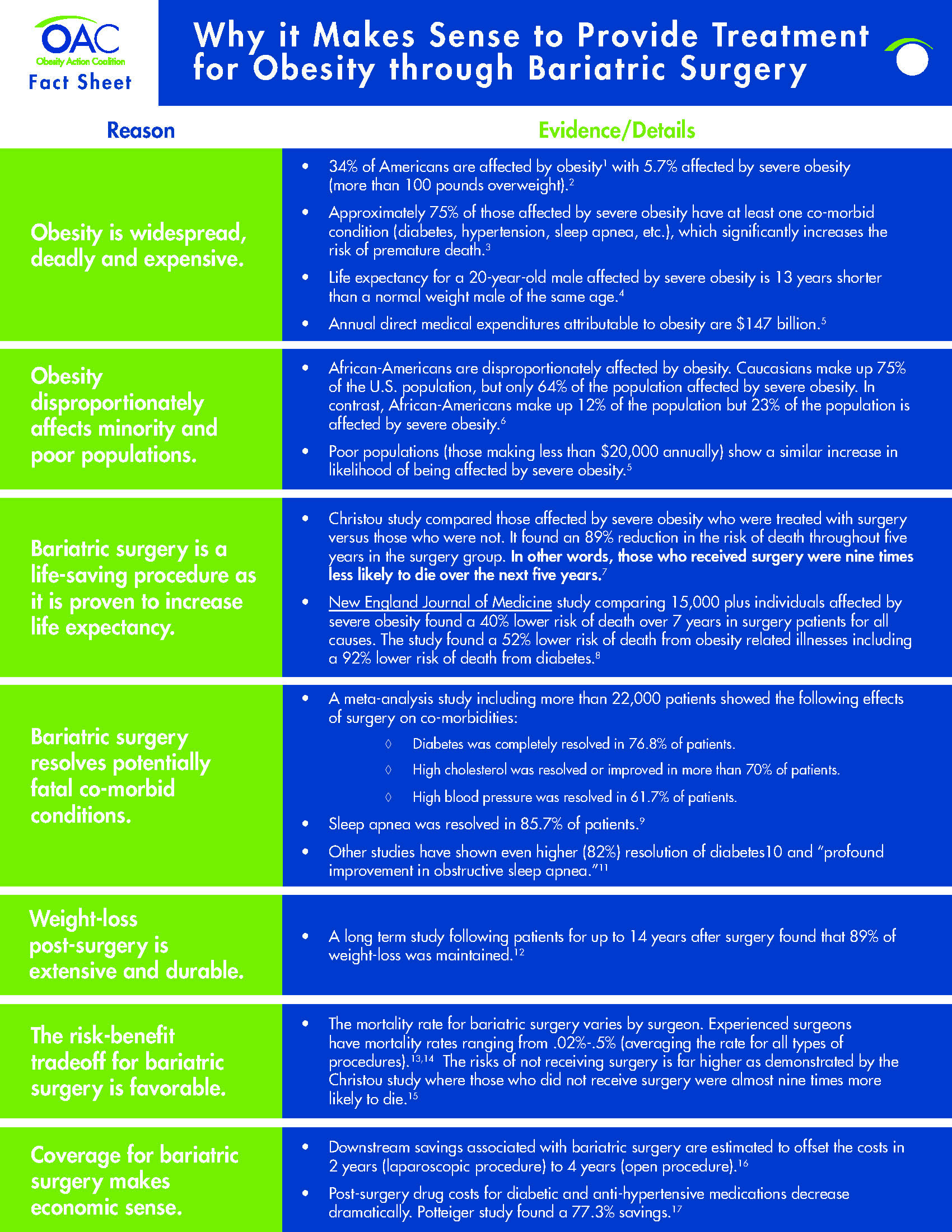

Read ArticleFact Sheet: Why it makes sense to provide treatment for obesity through bariatric surgery. Reason- Obesity is widespread,…

Read MoreThis guide is designed to provide individuals with the knowledge needed to successfully work with their insurance…

View Guide