Insurance Obstacles for Weight-loss Surgery Patients

by Amber Huett

Fall 2010

After the Decision of Bariatric Surgery

You’ve done it. Months (or years) of paperwork, initial exams, psychological counseling and insurance battles to get your weight-loss surgery (WLS) approved; then, the procedure. Now, whether you are 10 pounds into your journey or you’ve reached your goal weight, there still are challenges beyond just weight-loss. There is a bureaucratic obstacle course one must be willing to run, one that particularly affects WLS patients after their surgeries: attaining both health and life insurance.

If you are in the planning stages of WLS, prepare. Do as much research as possible to lessen the stress in this lifestyle transition. Be proactive; demand respect; ask for answers, in writing; appeal denials; gather support; and write letters. Leave little unknown as you head into life after surgery. Persistence is critical to obtaining the WLS you and your doctor have decided is best for you.

The Self-Pay Patient: The Realities of Footing Your Own Bill

Those fortunate enough to have insurance cover a portion or all of their WLS, the battle for healthcare access may be less brutal. It’s reassuring to be insured by a company with progressive ideals about WLS, which data has shown to be an effective tool to not only treat, but prevent obesity-related diseases.

The self-pay patient, however, often faces entirely different challenges. The financial and emotional trials can be stressful to those paying out of pocket. They then must figure out a savings program, dip into existing savings or secure low-cost financing.

Self-pay WLS patients should consider an insurance designed just for them. Many bariatric practices offer self-pay patients a short-term plan (usually 12 to 18 months) to cover complications that might arise throughout the period of the plan and require additional surgery. One of the most well-known companies is BLIS, which insures 110 surgeons in 25 states. As of January 2010, the company has paid $4.2 million in medical bills that would otherwise have to be paid by patients out-of-pocket.

Life Insurance and Insurance Denials

Life insurance companies may deny patients based on their weight, even after their WLS. Prior to applying, ask prospective insurance companies their height and weight guidelines. While you might be at a much healthier weight after surgery, insurance underwriters still must follow body mass index (BMI) guidelines.

If you are denied by a life insurance company, contact them and ask why. Sometimes the reasons are procedural, such as missing paperwork or requirements you can still work to meet. Re-submit your application. If you meet a life insurance company’s guidelines and are being turned down strictly because you had WLS, ask about an appeal process. Gather letters of support from your doctor and any medical professional who treated obesity-related diseases that have since been resolved or improved from a WLS procedure. Indicate your health status, especially if you are an otherwise healthy individual; gather documents supporting this.

Life insurance, by design, is different than health insurance. There are no others sharing risk in a life insurance plan; this causes a high number of denials because no other individuals offset money you are expected to cost the company. Premiums, or the amount you pay for the plans, are based on underwriting. They are given values based on height and weight, smoking status and other factors. And, unfortunately, there still are people denied because they had WLS.

WLS patients can discuss with insurance brokers about split risk, or insuring you in a small group of people. Many brokers will be unwilling to negotiate for you, but if you show willingness to work and knowledge of the issue, you might find someone willing to work for you.

To find out more about insurance brokers, log on to The National Association of Health Underwriters Web site at https://nahu.org/, which also has a “Find an Agent” search function to find brokers in your area. Coverage is not guaranteed, and likely includes a high deductible. But, many brokers who connect with a person go above and beyond to work with underwriters and get you insured.

The Action Plan:

Steps to take after you have been denied insurance. If you have been denied either health or life insurance, follow this action plan in hopes of obtaining individual coverage and advocating on behalf of fellow WLS patients.

- Appeal the decision with the insurance company. Contact the company on the appeals process. Gather documents and letters of support, including medical professionals who can speak to your health status.

- Contact your state’s insurance commission and ask how to file a formal complaint. To find your state’s insurance commission visit www.naic.org/state_web_map.htm. The individual state commissions typically give summarized versions of legislation in your state and might have resources that can help you locally.

- Consider contacting an insurance broker. It is possible to create small groups that will share risk and increase your chances of getting coverage. The National Association of Health Underwriters can provide more information about insurance brokers. It also allows you to search for brokers in your area at https://nahu.org/.

- Write your members of Congress. For contact information on your U.S. Senator or House of Representatives member, you can log on to www.usa.gov/Contact/Elected.shtml. Members of Congress are elected by the people in their districts; it’s in their best interest to listen to constituents. If you feel they are not serving your overall best interest, be sure you are registered to vote and speak with your constitutional right.

- Write your state legislators. To search the State Legislatures internet links, visit www.ncsl.org. Once there, click on your state and on the right, click “legislators.” Most state legislators are more accessible than members of Congress. Contact their district office and ask if they can sit down for a short meeting. It is in your best interest to gather support from local interest groups and fellow district voters who may be in a similar position. Get organized before meeting with your legislator.

Healthcare Reform Impact and Hope for the Future

In March 2010, the United States Congress passed landmark healthcare reform, which will be a game-changer for those without insurance. If you have a policy that does not change, it will not be subject to new regulations.

According to Morgan Downey of the Downey Obesity Report (www.downeyobesityreport.com), the new law will “strengthen the rights of consumers to appeals claims, denials and rescissions. In addition, an external review procedure will be available to review initial claims decisions.” If an insurance company rescinds coverage, it has canceled a policy due to sickness; and obesity has been known to be an accepted justification. In short, the legislation requires an objective review of insurance claims, which will help WLS patients who may have become victims of insurance discrimination.

While many of the healthcare provisions began in July 2010, the complete reform rolls out throughout several years. In 2014, those unable to get insurance through employers can enter state or regional risk pools. Those uninsured for six or more months as of July 2010 can apply for the Pre-Existing Condition Insurance (PCIP).

The Weight is Gone, but the Work is Not

Weight-loss surgery as a means of treating obesity is on the rise, which means the coverage problem will compound as people are left out of the insurance pool. Insurance provides companies a pooled risk, but it should not exclude people who have successfully taken control of their disease.

The country needs to focus on creating incentives for successful obesity intervention, especially for insurance companies. Economic incentives should be given to companies that allow access to post-operative bariatric patients who have obtained a healthy weight (not the unattainable and unrealistic BMI). Being denied insurance based strictly upon WLS is unjust. Do your research prior to making a decision and then use your voice to fight insurance discrimination. Articulate, because well-organized groups will be listened to by both federal and state representatives. You just have to be willing to speak up.

About the Author:

Amber Huett is an OAC Advisory Board Member and gastric-banding patient. She works for the state of Illinois, with experience in analyzing budgets, legislation and public health services. She is a graduate student at the University of Illinois-Springfield, earning her master’s degree in public administration. She has a bachelor’s degree in political science and journalism from Bradley University in Peoria, Illinois.

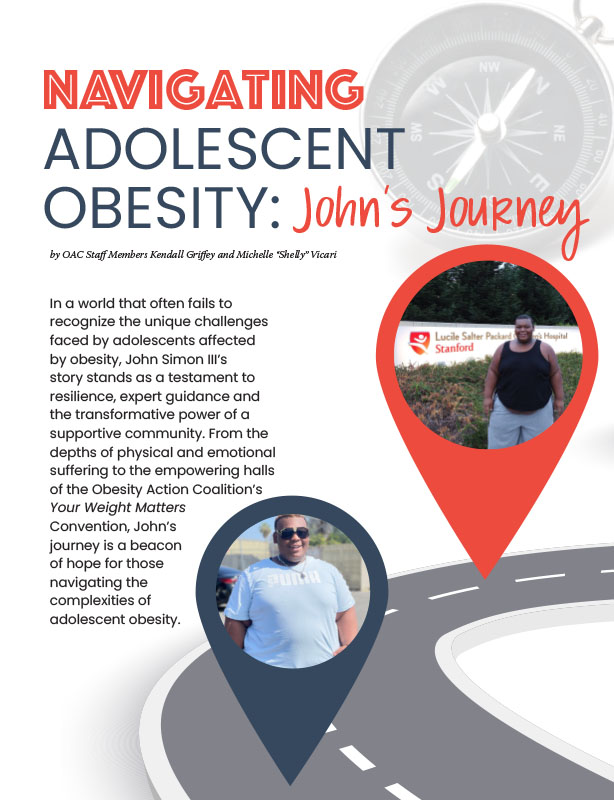

by OAC Staff Members Kendall Griffey and Michelle “Shelly” Vicari Winter 2024 In a world that often…

Read Articleby Rachel Engelhart, RD; Kelly Donahue, PhD; and Renu Mansukhani, MD Summer 2023 Welcome to the first…

Read ArticlePost-operative addiction is often overly simplified as transfer addiction or cross-addiction, assuming individuals “trade” compulsive eating for…

View Video